Did Paul Yates 3 letter process to the dca - they passed it to solicitors.

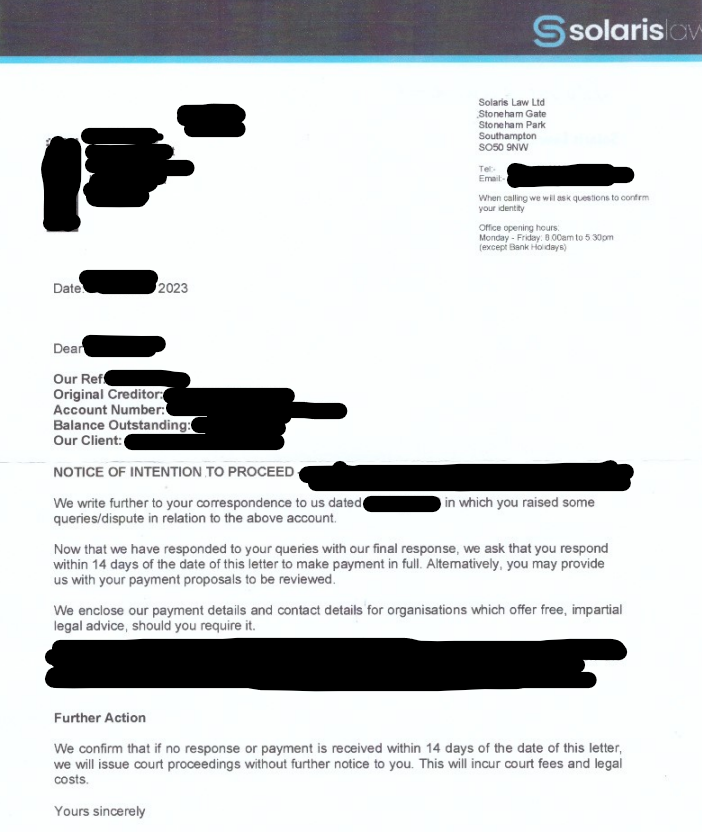

I did the 3 letter process to the solicitors - then I got this.

Paul makes it sound so easy, but this is not the whole story.

It doesn't work. My credit rating is f*cked. It was okay before. How do I get a new mortgage deal now?

DNR says: The simple truth is this: If you do not understand what you are doing then you can find yourself in great difficulty should the Bank or Credit Supplier challenge you.

Thanks to Paul Yates the Banks are now fully aware of this approach and they will no doubt have copies of the templates – which means that anyone using the templates is easily identifiable as someone that probably doesn’t know their stuff.

Most people who use templates – want an easy way out with little or no effort, no understanding and no research. They are led like lambs to the slaughter by someone like Paul Yates.

Hi all,

thank you so much for exposing paul yates.

I wanted to warn everybody about his book and his templates.

I thought I had quite a bit of knowledge but nothing can prepare you for the disappointment and negative energy when the bank or solicitors ignore the templates.

What do I do now?

They made it clear they don't have to return anything to me in advance of the loan being paid off and just kept on demanding payment. They even knew I was using templates. Since this letter they have issued court proceedings and it has just been referred to my local court. I'm beside myself with worry, because I could lose my job if I get a CCJ. I cannot tell you how much stress this is causing me.

DNR says: This lady informed us that the Bank was aware she had used templates. This will probably guarantee that anyone using the templates is likely to be tested/quizzed and unfortunately, many people will fail that test and end up being sued.

This is exactly what happened with the Get Out of Debt Free Website and Templates.

Greetings to you,

Today I received a claim pack from the Bulk Center.

The bank has included allegations that I obtained the loan with the intention of not paying, and are citing the debt ninjas templates and advert. I've been very stupid to fall for this. Do you think Yates is doing this on purpose? If he's as knowledgeable as he claims to be - why has he set everybody up to fail like this?

My wife is going nuts. I can't have a court claim for fraud held against me because I will lose my job in an instant.I'm so angry with Debt Ninjas and myself. DNR says: This is what we feared would happen. Everyone will be tarnished with the same brush.

What is it with these so called gurus.

They put themselves out there like they have all the answers but they don't.

I'm now hearing that Paul from Debt Ninjas has not cleared his own debts and was even taken to court himself, but he published a book telling others what to do - it pisses me off no end.

I had perfect credit and only challenged my cards because Paul said I could clear my credit file. He didn't say anything about being taken to court.

I even joined his Telegram group where he tells everyone it's a 99% success rate.

I have had no success - I have three cards. I challenged two, saving one just in case, but my credit rating is so bad, the third company - capital one - has just reduced my limit to £200. I bet I will lose that altogether soon.

Can you help me?

DNR says: Paul Yates is just another Iain Stamp. He clearly wants fame and fortune despite claiming to be the shy and introverted type – which coincidentally is precisely how Iain Stamp describes himself. Is this the strap line we need to be wary of when it comes to these self-declared experts?

Stating the obvious (see image below)!

According to Paul Yates – it takes 2-3 years to clear a CREDIT FILE!

Paul Yates wrote his book in 2022 (and printed examples of “alleged-success” dated “2021”)

THEREFORE: IT IS IMPOSSIBLE for him to have cleared his credit file BEFORE he WROTE the BOOK – because “2-3 years” had NOT PASSED! Yates has tripped himself up – JUST like Iain Stamp did!

Yates is CLEARLY LYING and was LYING in his book. We will, or course, remove this statement IF Yates can PROVE OTHERWISE! This STATEMENT will remain here until such time as Yates PROVES he has cleared his CREDIT FILE.

The FACT you are READING THIS STATEMENT proves that Yates CANNOT CLEAR CREDIT FILES – and he simply MADE IT ALL UP for attention, fame, money and notoriety. He does NOT have the expertise he claims to have.

The doctrine of promissory fraud aims to punish such insincere. promisors. If a court finds that a defendant-promisor did not intend at. the time of promising to perform her promise, then the court can subject her to both compensatory and punitive damages under the doctrine.

Ilhan Kekec fraudulently secured a £30,000 Covid Bounce Back Loan just months into the pandemic. Within weeks, he had applied to dissolve his business without informing creditors

He has been jailed for two-and-a-half years and banned as a company director for three years

The owner of a Turkish restaurant who illegally applied for a Covid Bounce Back Loan and then applied to dissolve his company without informing creditors has been jailed.

Ilhan Kekec was sentenced to two-and-a-half years in prison when he appeared at Isleworth Crown Court for sentencing on Monday 18 March. He was also disqualified as a company director for three years.

Kekec had denied charges of fraud by false representation and failing to notify creditors of a voluntary strike-off but was found guilty by a jury in December 2023.

Julie Barnes, Chief Investigator at the Insolvency Service, said: Ilhan Kekec saw an opportunity in the early weeks of the pandemic to receive a Covid loan which he never intended to repay. His actions were thoroughly dishonest and at no point did he ever own up to his crimes. He will now have the chance to reflect on his behaviour from behind bars.

Kekec, of Abbotts Drive, Waltham Abbey, Essex, applied for a £30,000 Bounce Back Loan in May 2020, falsely claiming the turnover of this Hizirali Ltd business was £125,000. Hizirali was set up by Kekec to run the Derwish Kebab Restaurant inside the food court of the East Shopping Centre on Green Street, Forest Gate, London. Kekec had traded for three years through Helosh Ltd as the Derwish Restaurant on St Albans Road, Watford, before opening this second restaurant.

However, his new venture only traded for three weeks before the Covid lockdown, and he was unable to open during that period. Kekec withdrew the Bounce Back Loan money in cash and later admitted to Insolvency Service investigators that he spent the funds on clearing personal debts.

He applied to dissolve his company in June 2020, claiming it was no longer economically viable for him to run the restaurant. However, he deliberately failed in his statutory duty to inform his creditors within seven days of his voluntary strike-off application with Companies House.

Kekec was sentenced to two-and-a-half years each for two counts of fraud by false representation, and two years and four months respectively for offences under the Companies Act, with the sentences to run concurrently.

He is now subject to confiscation proceedings which have been scheduled for this year.

A Mississauga man has been arrested and charged with fraud after allegedly racking up more than $1 million in credit card debt he never paid back.

In November 2020, the Ontario Provincial Police (OPP) launched an investigation after a large credit card company notified them that an individual had more than $1 million in outstanding payments.

Investigators allege that the suspect used their credit card to make payments to financial aggregators, “cycling money through companies and individuals controlled by or associated to them.” In doing so, police said their credit card limit was elevated high enough that the suspect was able to incur more than $1,000,000 in outstanding payments that they never paid back.

On Tuesday, the OPP announced it had arrested and charged Naveed Nadir, 57, with one count of fraud over $5,000 and one count of uttering a forged document.

The accused has been released from custody and is scheduled to appear at the Ontario Court of Justice in Toronto on Feb. 22.

Kulwinder Singh Sidhu, 58, from Stanwell, has been sentenced to 12 months imprisonment, after pleading guilty to offences under the Companies Act and the Fraud Act, having abused the Bounce Back Loan financial support scheme in 2020.

Sidhu was director of Wavylane Ltd, a haulage company based in Stanwell, and which had been trading since 2010.

On 9 June 2020 Sidhu applied for a £50,000 Bounce Back Loan from his bank on behalf of his business. Under the Bounce Back Loan scheme, genuine businesses impacted by the pandemic could take out interest-free taxpayer-backed loans of up to a maximum of £50,000.

The loan was paid into the company bank account and on 26 June 2020 Sidhu filed paperwork with Companies House to have the business dissolved, having transferred the funds to his personal bank account within two days of receipt.

The striking-off application to dissolve the company was explicit that interested parties and creditors, such as a bank with an outstanding loan, must be notified within seven days of making an application to dissolve a company. The form also highlighted that failure to notify interested parties is a criminal offence, however Sidhu did not follow these rules.

The company was dissolved in October 2020, and was subsequently identified as likely Bounce Back Loan fraud by the Insolvency Service and cross-government counter-fraud systems.

The Insolvency Service investigation found that Sidhu had fraudulently overstated the company turnover in the Bounce Back Loan application, and within two days of receiving the money he had transferred it to his personal account before dispersing the funds to his son and another company.

He pleaded guilty to charges under the Companies Act 2006 and Fraud Act 2006 at Guildford Crown Court on 19 December 2022. He was sentenced on 13 February 2023 at Guildford Crown Court.

The court imposed a confiscation order for £50,000, and Sidhu has paid this in full.

In addition to the custodial sentence, Sidhu was also disqualified as a director for six years.

Julie Barnes, Chief Investigator at the Insolvency Service said:

Our action has ensured repayment of the loan money and taxpayers have not been left out of pocket.

Any other company directors who might be tempted into dissolving their business to try to keep public money they are not entitled to, should be aware they are risking a lengthy prison term.